Dec 3, 2019 · Paul Zwaska

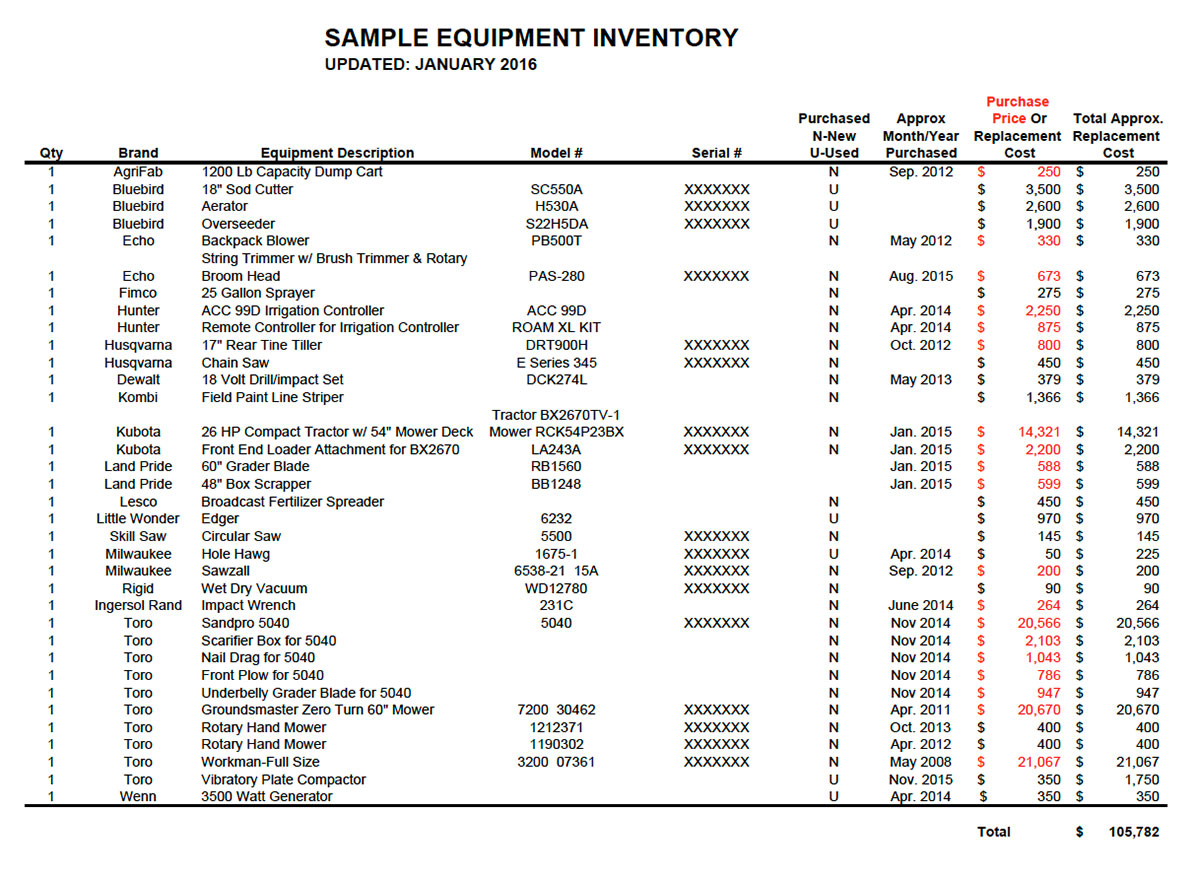

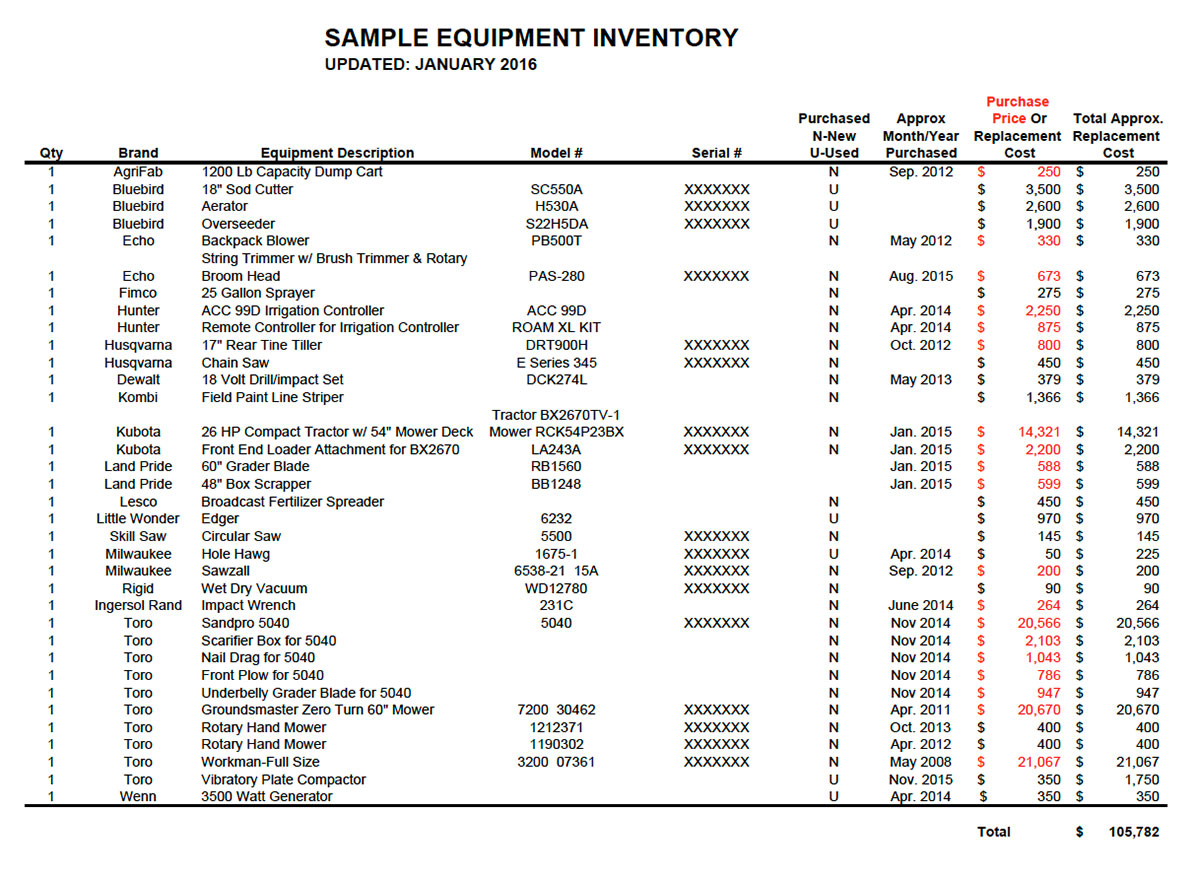

As we move our operation from the growing season to the off-season at the little league complex where I volunteer, we also perform an annual inventory. This inventory is used to update our insurance coverage each year. As a manager, you want to protect all the investments your organization has made in the tools and equipment that you use to perform your job. If ever there is a fire, theft or act of nature, you need the ability to prove to insurers what you had on hand and how much it was worth based on the purchase price and age of the equipment. Over the course of a year new equipment & tools are added (purchased) while equipment is retired, so it’s important to update your inventory annually (see sample inventory document below).The information collected is tracked with a spreadsheet and includes the make, model and serial numbers for mechanized equipment as well as whether it was purchased new or used. A picture is also taken of each piece of equipment and dropped into the document. We provide the insurance company the actual purchase price of the equipment and have coverage that pays full replacement cost. That type of policy is a little more pricey but should an unfortunate situation occur where you lose a majority of your equipment, you get the full replacement cost of the equipment with just your deductible to pay. That’s peace of mind I like to have.The full crew is involved in this process so they learn the importance of keeping a record of this information and where to find it. The crew first goes through the list from the previous year and they remove any equipment or tools we have parted ways with. Then they go through and recount all of the existing items on the list to make sure all counts of hand tools, power tools, office equipment and furniture are accurate or adjusted, if need be. Finally, they get to the larger field maintenance equipment and double check all model and serial numbers.

As we move our operation from the growing season to the off-season at the little league complex where I volunteer, we also perform an annual inventory. This inventory is used to update our insurance coverage each year. As a manager, you want to protect all the investments your organization has made in the tools and equipment that you use to perform your job. If ever there is a fire, theft or act of nature, you need the ability to prove to insurers what you had on hand and how much it was worth based on the purchase price and age of the equipment. Over the course of a year new equipment & tools are added (purchased) while equipment is retired, so it’s important to update your inventory annually (see sample inventory document below).The information collected is tracked with a spreadsheet and includes the make, model and serial numbers for mechanized equipment as well as whether it was purchased new or used. A picture is also taken of each piece of equipment and dropped into the document. We provide the insurance company the actual purchase price of the equipment and have coverage that pays full replacement cost. That type of policy is a little more pricey but should an unfortunate situation occur where you lose a majority of your equipment, you get the full replacement cost of the equipment with just your deductible to pay. That’s peace of mind I like to have.The full crew is involved in this process so they learn the importance of keeping a record of this information and where to find it. The crew first goes through the list from the previous year and they remove any equipment or tools we have parted ways with. Then they go through and recount all of the existing items on the list to make sure all counts of hand tools, power tools, office equipment and furniture are accurate or adjusted, if need be. Finally, they get to the larger field maintenance equipment and double check all model and serial numbers.

Next, our crew adds all of the new equipment acquired this year. Invoices are used to record the original price paid and the date purchased. If you purchase some large or pricey pieces of equipment with a lease or lease-to-own agreement, you probably have already alerted your insurance company. But in general, it is good business practice to supply your insurance company with a comprehensive list of all of your equipment together for quick and easy reference.

An organization spends years accumulating the equipment and tools needed to operate a facility. But, it can all be gone in the blink of an eye. Be sure to document your equipment and adequately insure it. The more comprehensive your records for your insurance company, the faster you will receive a check to replace what you lost after a theft or catastrophic event.

0 Comments